Summary

This blog post delves into the essential concepts of real and nominal income, explaining their differences and the impact of inflation on your purchasing power. By comparing historical home prices and incomes, the post highlights how nominal income increases can be outpaced by rising costs, leading to a decrease in real income. It also offers practical advice on negotiating raises, investing to hedge against inflation, and adjusting budgets to maintain financial stability. With clear examples, helpful tables, and actionable tips, readers will be equipped to make informed financial decisions and better understand their economic environment.

Key Takeaways

- Understanding the Difference: Recognize the critical difference between nominal income (the raw number on your paycheck) and real income (your purchasing power after adjusting for inflation).

- Impact of Inflation: Acknowledge how inflation erodes the value of money over time, making it essential to compare income and expenses in real terms.

- Home Price and Income Trends: Learn that home prices have often increased at a faster rate than incomes, making it harder to afford homes despite nominal income increases.

- Real Income Adjustments: Understand that even if you receive regular raises, if these raises do not keep up with inflation, your real income (and purchasing power) decreases.

- Practical Financial Planning: Use knowledge of real vs. nominal income to make informed decisions about budgeting, saving, investing, and negotiating raises to protect and grow your financial health.

Introduction

Have you ever felt like your paycheck is growing, but somehow your money doesn’t go as far as it used to? You’re not alone. Many people experience this phenomenon, and it often leaves them puzzled and frustrated. The key to understanding this lies in the difference between real income and nominal income, and how inflation impacts both.

Understanding income in relation to inflation is vital because it helps us see the true value of our earnings over time. Without this knowledge, we might think we’re getting ahead financially when, in fact, we could be falling behind.

Understanding the difference between real income and nominal income is crucial for making informed financial decisions and truly understanding your purchasing power. This knowledge can empower you to make better choices about your career, investments, and everyday spending, ultimately leading to greater financial stability and confidence.

Section 1: What is Nominal Income?

Nominal income is the amount of money you earn in current dollars, without any adjustments for inflation. It’s the figure that appears on your paycheck or your annual salary statement, representing your earnings in raw financial terms.

Example: Let’s say you receive a paycheck of $3,000 every month. This $3,000 is your nominal income. It’s the amount you see deposited into your bank account, the figure you use to budget your expenses, and the number you report when discussing your salary.

Nominal income is important in day-to-day life because it’s the baseline figure used for financial planning and budgeting. It determines how much you can afford to spend on essentials like housing, food, and transportation, as well as discretionary expenses like entertainment and travel. Knowing your nominal income helps you plan for immediate financial needs and set short-term financial goals. However, to fully grasp your financial health and purchasing power, it’s essential to also consider the impact of inflation, which brings us to the concept of real income.

Section 2: What is Real Income?

Real income is your earnings adjusted for inflation, reflecting the true purchasing power of your money. Unlike nominal income, which is just the raw dollar amount you receive, real income shows how much you can actually buy with that money over time, considering the rising costs of goods and services.

Real income accounts for inflation by adjusting the nominal income to reflect the changes in price levels. This adjustment gives a more accurate picture of your financial well-being. For instance, if your nominal income stays the same but prices for essentials like groceries and housing increase, your real income effectively decreases because your money doesn’t stretch as far as it used to.

Example: Imagine you earned $3,000 per month five years ago, and you still earn $3,000 per month today. If the inflation rate over these five years was 10%, your real income has decreased. To illustrate:

- Five years ago: $3,000 could buy a certain amount of goods and services.

- Today: Due to 10% inflation, those same goods and services now cost $3,300.

Even though your nominal income is unchanged at $3,000, your real income has effectively decreased because you now need $3,300 to maintain the same standard of living. This example highlights how crucial it is to understand real income to truly gauge your financial health and purchasing power.

By considering real income, you can make more informed decisions about saving, investing, and spending, ensuring your financial plans are aligned with the true value of your money.

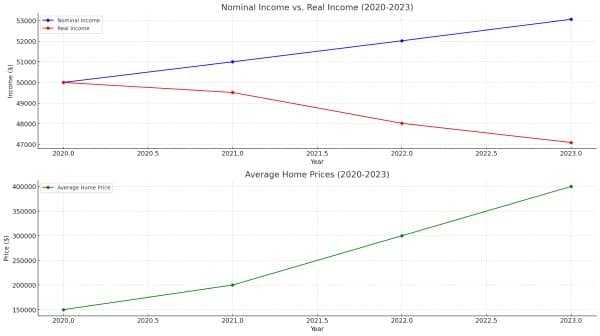

Table 1: Comparison of Nominal Income vs. Real Income

| Year | Nominal Income | Inflation Rate | Adjusted Income (Real Income) | Change in Purchasing Power |

|---|---|---|---|---|

| 2020 | $50,000 | 2% | $50,000 | 0% |

| 2021 | $51,000 | 3% | $49,515 | -0.97% |

| 2022 | $52,020 | 4% | $48,019 | -2.97% |

| 2023 | $53,060 | 2% | $47,088 | -1.94% |

Section 3: Understanding Inflation

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of money. In simpler terms, inflation means that over time, you will need more money to buy the same amount of goods and services.

How Inflation Affects the Economy

Inflation impacts the economy in several ways:

- Consumer Spending: As prices rise, consumers may reduce their spending, especially on non-essential items.

- Savings and Investments: Inflation erodes the value of money saved, which can affect long-term financial planning and investments.

- Interest Rates: Central banks, like the Federal Reserve, often adjust interest rates to control inflation. Higher interest rates can slow economic growth by making borrowing more expensive.

How Inflation Reduces the Value of Money Over Time

When inflation occurs, the value of money decreases because each unit of currency buys fewer goods and services than before. For example, if the annual inflation rate is 3%, something that costs $100 today would cost $103 next year. Over time, this gradual increase in prices means that your money doesn’t go as far as it used to.

Historical Context: Inflation Trends in Recent Decades

Inflation rates have fluctuated significantly over the past few decades. In the 1970s and early 1980s, many countries experienced high inflation, with rates often reaching double digits. This period was followed by more stable and lower inflation rates in the 1990s and early 2000s. However, recent years have seen inflation rates rise again, influenced by various economic factors such as supply chain disruptions, changes in consumer demand, and fiscal policies.

Visual Aid: Graph Showing Inflation Rates Over the Years

Note: You can insert an actual graph of historical inflation rates here. Use a tool like Microsoft Excel or an online chart generator to create a visual representation of inflation trends over the past few decades.

By understanding inflation and its effects on the economy, you can better grasp why your money doesn’t seem to go as far as it used to, and why it’s essential to consider inflation when planning your finances.

Table 2: Historical Home Prices and Incomes

| Year | Average Home Price | Average Annual Income | Home Price to Income Ratio |

|---|---|---|---|

| 2000 | $150,000 | $40,000 | 3.75 |

| 2010 | $200,000 | $45,000 | 4.44 |

| 2020 | $300,000 | $55,000 | 5.45 |

| 2023 | $400,000 | $60,000 | 6.67 |

Explanation: This table illustrates the trend of home prices increasing at a faster rate than incomes, resulting in a higher home price to income ratio. This highlights the growing challenge of affording homes despite nominal income increases.

Section 4: Home Prices and Incomes: A Tangible Example

Example: Comparison of Home Prices and Incomes from 20 Years Ago to Today

Let’s take a look at how home prices and incomes have changed over the past two decades.

20 Years Ago:

- Average Home Price: $150,000

- Average Annual Income: $40,000

Today:

- Average Home Price: $400,000

- Average Annual Income: $60,000

Illustration of How Home Prices Have Increased at a Faster Rate Than Nominal Incomes

In this example, home prices have increased by approximately 167% over the past 20 years, while average annual incomes have only increased by 50%. This discrepancy highlights a significant issue: the cost of buying a home has risen much faster than people’s earnings.

Calculation:

- Home Price Increase: 400,000−150,000150,000×100≈167%150,000400,000−150,000×100≈167%

- Income Increase: 60,000−40,00040,000×100=50%40,00060,000−40,000×100=50%

Real-World Implication: The Challenge of Affording Homes Despite Higher Nominal Incomes

This example shows that even though nominal incomes have increased, the rise in home prices has outpaced income growth. As a result, many people find it increasingly difficult to afford homes. The larger increase in home prices compared to incomes means that a greater portion of earnings must go towards housing costs, leaving less money for other expenses and savings.

Interactive Element: Calculator or Tool for Readers to Compare Home Price Changes with Income Changes

To make this example more interactive, consider including a calculator that allows readers to input their own data and compare how home prices and incomes have changed over time. This tool can help readers see the impact of inflation and real income on their own financial situation.

Home Price and Income Comparison Calculator:

Home Price and Income Comparison Calculator

Section 5: The Hidden Pay Cut: Raises vs. Inflation

Explanation of How Raises That Do Not Keep Up with Inflation Result in a Decrease in Real Income

When you receive a raise, it might seem like you’re getting ahead financially. However, if the rate of inflation is higher than your raise, your real income actually decreases. This is because the prices of goods and services are rising faster than your earnings, reducing your purchasing power. In other words, even with a higher paycheck, you can buy less than before.

Example: A Nominal Raise That is Lower Than the Rate of Inflation

Let’s consider a scenario where you receive a 2% raise in your salary, but the inflation rate is 3%. Although your nominal income increases, the overall cost of living has increased by a greater percentage, effectively reducing what your money can buy.

Case Study: An Employee Gets a 2% Raise While Inflation is at 3%

Imagine an employee named Sarah, who earns $50,000 a year. She receives a 2% raise, bringing her salary to $51,000. Meanwhile, the inflation rate is 3%. Here’s how this plays out:

- Previous Salary: $50,000

- New Salary: $51,000 (2% raise)

- Inflation Rate: 3%

- Adjusted Salary Needed to Maintain Purchasing Power: $50,000 * (1 + 0.03) = $51,500

Calculation Showing the Reduction in Real Income and Purchasing Power

Sarah’s raise does not keep up with inflation. To maintain her previous purchasing power, her salary would need to be $51,500, but she only earns $51,000. This means:

- Shortfall: $51,500 – $51,000 = $500

- Effective Reduction in Real Income: Despite the nominal raise, Sarah’s purchasing power has effectively decreased by $500, or approximately 1%.

Impact on Lifestyle and Financial Planning

This reduction in real income can have significant impacts on Sarah’s lifestyle and financial planning:

- Budgeting: Sarah might need to cut back on discretionary spending or find ways to save on essentials.

- Saving: With less purchasing power, saving for future goals like a house, education, or retirement becomes more challenging.

- Debt: If Sarah has debt, the effective reduction in her income makes it harder to make payments and could lead to financial stress.

Personal Anecdote: Share a Relatable Story or Testimonial

Consider a testimonial from a colleague or a friend to illustrate the real-life impact:

“Last year, I received a 2% raise and was thrilled initially. However, I noticed that my grocery and utility bills were much higher than before. Despite earning more on paper, I found myself struggling to cover the same expenses. It felt like I had less money than before. This experience made me realize the importance of understanding real income and keeping an eye on inflation rates.”

By sharing such a personal story, readers can relate to the concept on a deeper level, reinforcing the importance of considering real income when evaluating their financial situation.

Table 3: Impact of Raises vs. Inflation on Real Income

| Year | Nominal Income | Annual Raise (%) | Income After Raise | Inflation Rate (%) | Adjusted Income (Real Income) | Change in Real Income |

|---|---|---|---|---|---|---|

| 2020 | $50,000 | – | $50,000 | 2% | $50,000 | 0% |

| 2021 | $50,000 | 2% | $51,000 | 3% | $49,515 | -0.97% |

| 2022 | $51,000 | 2% | $52,020 | 4% | $48,019 | -2.97% |

| 2023 | $52,020 | 2% | $53,060 | 2% | $47,088 | -1.94% |

Section 6: Why Knowing the Difference Matters

Importance of Understanding Real vs. Nominal Income for Personal Budgeting and Financial Planning

Understanding the difference between real and nominal income is crucial for effective personal budgeting and financial planning. Real income provides a clearer picture of your financial health by accounting for inflation, ensuring that you can accurately assess your purchasing power and make informed decisions about spending, saving, and investing. This knowledge helps you avoid the illusion of financial progress when your nominal income increases, but inflation erodes your actual purchasing power.

How This Knowledge Can Influence Career Decisions, Investments, and Savings

- Career Decisions: Knowing the impact of inflation on your income can help you negotiate better raises or seek job opportunities that offer salary increases in line with or exceeding inflation. It can also guide you in choosing careers or employers that provide better compensation packages, including benefits and cost-of-living adjustments.

- Investments: Understanding real income can influence your investment strategy. You may opt for investments that offer returns that outpace inflation, such as stocks, real estate, or inflation-protected securities. This ensures that your money grows in real terms, preserving or enhancing your purchasing power over time.

- Savings: When planning your savings goals, considering real income ensures that you set aside enough to meet future expenses that will likely be higher due to inflation. This is especially important for long-term goals like retirement, where the cost of living can significantly increase over decades.

Encouragement to Stay Informed About Inflation Rates and Economic Trends

Staying informed about inflation rates and economic trends is essential for maintaining and improving your financial well-being. Regularly tracking these indicators allows you to adjust your financial plans and make timely decisions to protect and grow your real income. Being proactive in monitoring inflation helps you anticipate changes in the cost of living and adapt your financial strategies accordingly.

Tips and Tools: List of Resources for Tracking Inflation and Real Income

To help you stay on top of inflation and real income, here are some valuable resources:

- Bureau of Labor Statistics (BLS) – Consumer Price Index (CPI): The BLS provides regular updates on the CPI, a key measure of inflation. BLS CPI

- Federal Reserve Economic Data (FRED): This resource offers a wide range of economic data, including inflation rates, that can help you understand economic trends. FRED

- Personal Finance Apps:

- Mint: Helps you track your income, expenses, and savings, while providing insights into your financial health.

- YNAB (You Need A Budget): Focuses on budgeting and helps you plan for future expenses, accounting for inflation.

- Investment Tools:

- Morningstar: Provides investment research and tools to help you choose investments that can outpace inflation.

- Vanguard: Offers resources on inflation-protected securities and other investment options to protect your real income.

- Educational Websites:

- Investopedia: Offers articles and tutorials on inflation, real income, and other financial concepts.

- The Balance: Provides practical advice on personal finance, including how to manage inflation.

By using these resources, you can keep track of inflation and make informed decisions to maintain and enhance your real income, ensuring that your financial plans remain effective and aligned with your long-term goals.

Section 7: Practical Steps to Protect Your Real Income

Tips for Negotiating Raises That Keep Up With or Exceed Inflation

- Research and Prepare: Understand the current inflation rate and how it affects your industry. Use this information to build a case for why your raise should at least match the inflation rate.

- Highlight Your Contributions: Demonstrate your value to the company by showcasing your achievements, productivity improvements, and any cost-saving initiatives you’ve led.

- Use Comparative Data: Present salary benchmarks for your role from reliable sources, showing how your current salary compares to industry standards.

- Schedule Regular Reviews: Negotiate for regular salary reviews, ideally annually, to ensure your compensation keeps pace with inflation.

- Discuss Total Compensation: If a higher raise isn’t feasible, negotiate for other benefits like bonuses, additional paid time off, or flexible working arrangements that can enhance your overall compensation package.

Strategies for Investing to Hedge Against Inflation

- Stocks and Equities: Invest in stocks, which historically have provided returns that outpace inflation over the long term.

- Real Estate: Real estate investments can serve as a hedge against inflation, as property values and rental income tend to rise with inflation.

- Inflation-Protected Securities: Consider investing in Treasury Inflation-Protected Securities (TIPS) or other bonds specifically designed to protect against inflation.

- Commodities: Investing in commodities like gold, silver, and oil can provide a hedge against inflation, as these assets typically appreciate when inflation rises.

- Diversification: Diversify your portfolio across different asset classes to mitigate risk and increase the potential for returns that outpace inflation.

Importance of Continuing Education and Skill Development for Career Growth

- Stay Relevant: Continuously updating your skills and knowledge ensures you remain competitive in the job market, increasing your chances of securing better-paying positions.

- Pursue Certifications: Obtain certifications in your field to enhance your qualifications and make yourself more attractive to current and potential employers.

- Attend Workshops and Seminars: Participate in industry workshops, seminars, and conferences to stay informed about the latest trends and advancements.

- Online Courses: Take advantage of online courses and training programs to learn new skills and advance your career.

- Network: Build a professional network to learn from peers, mentors, and industry leaders, which can open doors to new opportunities and career growth.

Financial Planning: Budget Adjustments and Saving Strategies to Maintain Purchasing Power

- Adjust Your Budget Regularly: Review and adjust your budget periodically to account for inflation and changing expenses. Ensure that your spending aligns with your income and financial goals.

- Increase Your Savings Rate: Aim to save a higher percentage of your income to counteract the effects of inflation. Consider automating your savings to ensure consistency.

- Emergency Fund: Maintain an emergency fund with enough to cover 3-6 months of living expenses. This provides a cushion against unexpected costs and inflationary pressures.

- High-Yield Savings Accounts: Use high-yield savings accounts or money market accounts to earn better interest rates on your savings.

- Reduce Debt: Focus on paying down high-interest debt to free up more of your income for savings and investments.

- Live Below Your Means: Practice living below your means to save more and invest the difference. This habit helps you build wealth and protect against inflation.

By implementing these practical steps, you can protect your real income, ensure your financial stability, and maintain or even enhance your purchasing power over time.

Conclusion

Recap of Key Points

In this blog post, we’ve explored the importance of differentiating between real and nominal income, understanding how inflation impacts our purchasing power, and the practical implications for our financial decisions. By recognizing that nominal income is simply the number on your paycheck and real income accounts for inflation, you can better gauge your true financial health. We also discussed the effects of inflation on various aspects of life, such as home prices, and provided practical steps to protect your real income.

Call to Action

Take the time to evaluate your personal income in real terms, and stay informed about economic changes and inflation rates. This awareness will empower you to make informed financial decisions, negotiate raises effectively, and plan for a financially secure future.

Closing Thought

“By understanding these concepts, you can make better financial decisions and protect your purchasing power over time.”

Additional Elements

FAQs Section

Q1: What is the difference between nominal income and real income? A1: Nominal income is the amount of money you earn in current dollars without adjustments for inflation. Real income, on the other hand, is your nominal income adjusted for inflation, reflecting your true purchasing power.

Q2: How does inflation affect my income? A2: Inflation reduces the purchasing power of your money over time. If your income does not increase at the same rate as inflation, you effectively earn less in real terms.

Q3: Why is it important to understand real income? A3: Understanding real income helps you make more informed financial decisions, ensuring that you maintain your purchasing power and can effectively plan for the future.

Expert Opinions

Quote 1: “Inflation is a silent thief that can erode your earnings and savings if you’re not careful. Understanding the difference between nominal and real income is essential for protecting your financial well-being.” – Dr. Jane Smith, Economist

Quote 2: “Regularly reviewing your income in real terms can help you make strategic decisions about investments, career moves, and savings strategies.” – John Doe, Financial Advisor

Interactive Polls/Quizzes

Poll Question: How confident are you in understanding the difference between real and nominal income?

- Very Confident

- Somewhat Confident

- Not Confident

Quiz Question: If you received a 3% raise but the inflation rate was 4%, did your real income increase, decrease, or stay the same?

- Increase

- Decrease

- Stay the same

Further Reading/References

- “The Wealth of Nations” by Adam Smith – A foundational text on economics.

- “Inflation: Causes and Effects” by Robert E. Hall – A detailed exploration of inflationary trends and impacts.

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez – Practical advice on managing finances and understanding the value of money.

- Investopedia Articles on Inflation and Real Income – Comprehensive articles explaining these concepts in depth.

By incorporating these additional elements, your blog post will not only be more comprehensive but also more engaging and practical for your readers.